Argentina looks to unlock LNG exports

Longer term goals could see the country to extend LNG export reach and poses opportunities for shipping

LNG tonne-mile demand may suffer from Argentina’s plans to become more energy independent by exploiting its vast shale reserves. The nation’s state-run oil company has longer term goals to export via a large-scale LNG terminal, opening up opportunities for greater shipping exports from the region.

Figures from the IEA’s latest Gas Market Report showed flat demand for gas in Argentina in the first half of 2022, but an 11% increase year-on-year in LNG imports over the first seven months of 2022.

A flurry of MoU signings in Argentina between energy companies and oil majors signal the country’s ambition to reduce its reliance on LNG imports as gas prices rise and to become a net exporter in the future.

At a recent energy summit, state-run oil company YPF said it saw a unique opportunity to reach record highs in total crude oil and natural gas production in Argentina through shale extraction. Its 2026 estimate was for 160-170 MMm3/D of gas up from 124 MMm3/D in 2021, with increased shale volumes offsetting a continued decline in other oil and gas production methods. Extraction costs will continue to fall to internationally competitive levels, it forecast.

YPF and Malaysian oil company Petronas signed an LNG feasibility study in September to assess the viability of a $10bn export terminal on the Atlantic coast.

For an export terminal to become viable, Argentina must first break its seasonal reliance on LNG imports. In 2021, Argentina imported 56 cargoes of LNG, mainly from Qatar and the USA. Import cargoes for 2022 total 41 up to the most recent tender in June, from more diverse origins.

A series of new gas pipelines under the Transport.Ar plan are due to be built to relieve bottlenecks on Argentina’s Vaca Muerta shale deposit, the second-largest shale deposit in the world. Ongoing growth at the shale field is straining against equipment and logistical constraints.

Among the objectives of the plan are to enable the export of surplus natural gas to neighbouring countries, potentially another bad signal for LNG tonne-miles if Argentina not only replaces its own LNG imports, but offers a closer origin for its neighbours.

YPF said it sees “Further opportunities in the medium/long term through a large-scale LNG terminal and off-shore potential”

Related content

Progressing port transparency on alternative fuels

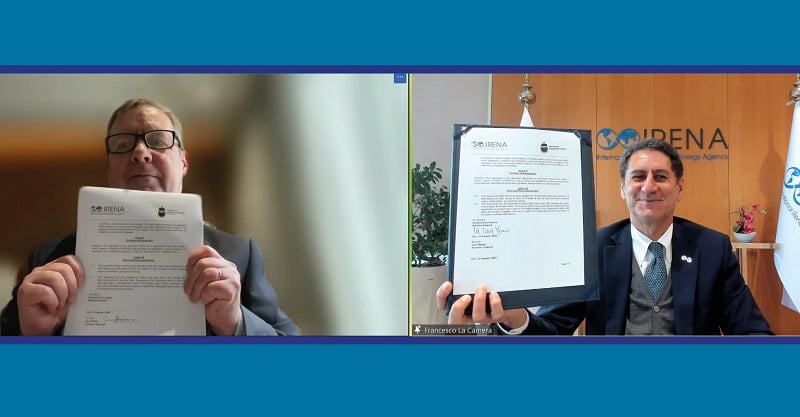

Shipping and renewable energy bodies join forces to advance global green fuel transition

Allard Castelein: Forging a path for future-proof ports