Supply of core components for renewable energy projects could become a major obstacle to the global energy transition and the availability of green fuels for shipping, according to recent analyses. Reports identify potential upcoming shortages in the high-voltage DC cables that connect offshore energy projects to land and in the production of electrolysers needed to convert electricity to hydrogen.

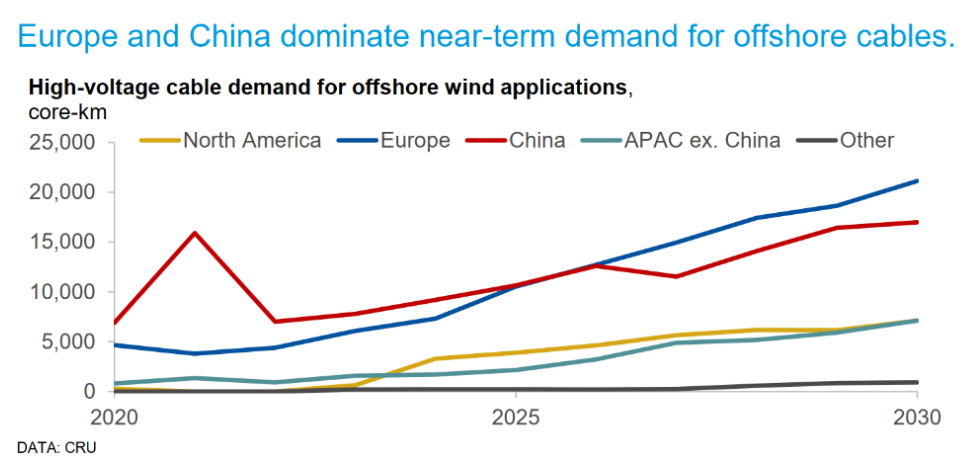

CRU Group has gathered data showing that supply of high-voltage cables may become a bottleneck in the rollout of offshore wind energy projects. “In 2022, only about 0.5% of global energy cable production facilities were capable of producing submarine cables,” CRU Group head of wires and cables Chenfei Wang told ICS Leadership Insights. “Already these existing, highly specialised manufacturers in Europe are fully booked, with multiple-year backlogs of cable demand.”

In a forthcoming report for the Global Wind Energy Council (GWEC), the market analyst points to surging demand for both array cables, which connect individual turbines together, and export cables, which connect offshore substations to an onshore grid location. Highlights shown to ICS Leadership Insights ahead of publication project that demand will grow at an average of 12% a year for the rest of the decade.

Historically, geopolitical factors have influenced the selection of cable suppliers to flagship regional projects, meaning that supply chains have been intra-regional. But as production capacity is squeezed, a higher level of global collaboration is “imperative” to safeguard international decarbonisation goals, says Wang.

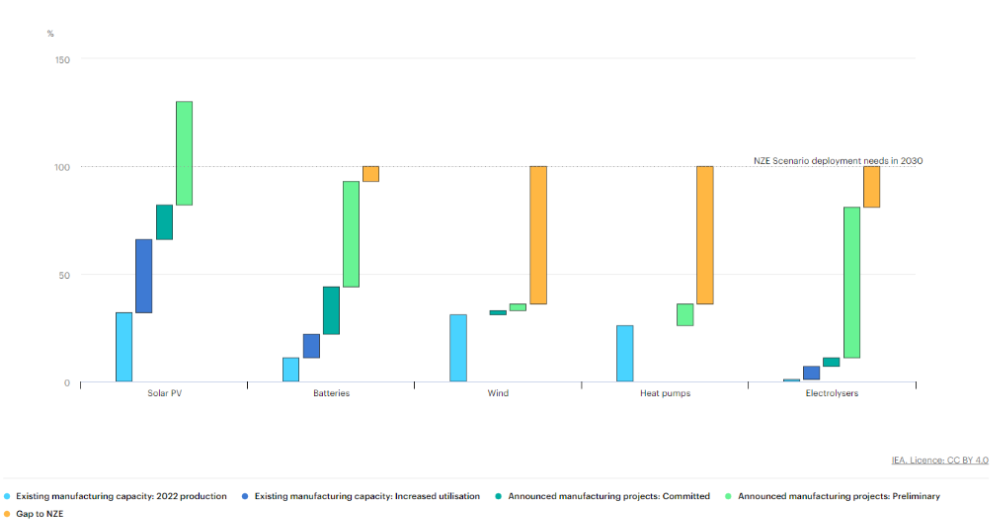

The International Energy Agency (IEA) recently noted a similar capacity challenge for electrolysers. The relatively novel technology has yet to reach either the individual unit capability or the production capacity needed to satisfy green fuel production to a level projected under IEA’s Net Zero 2050 scenario. Announced projects to produce electrolysers could be expected to reach 136 GW by 2030, leaving a 40% gap between the capacity IEA believes would be needed to fulfil a net-zero economy. Counting only projects where the final investment decision has been made, the gap would be more than 90%.

CHART TITLE: Manufacturing capacity of key net-zero technologies to 2030

A survey released this month by turbocharger supplier Accelleron confirmed that those concerns are feeding into scepticism about the imminent availability of green fuels to shipping. Of around 200 European maritime stakeholders, including 70 shipowners, 44% expect availability to remain poor beyond 2030, by which time the International Maritime Organization (IMO) aims for up to 10% of shipping’s energy demand to be met by zero or near-zero carbon fuels. Incentivising green fuel production infrastructure was seen as a more important measure to assure availability than funding research or developing the regulatory framework further.

Speaking to ICS Leadership Insights after a recent visit to an electrolyser production plant, Accelleron CEO Daniel Bischofberger said: “Electrolysers need to be both scaled up and more widely available to meet anticipated green fuel demand. The current size of the biggest electrolysers, around 100 MW, will not scratch the surface of shipping’s – and certainly not the world’s – future hydrogen needs.”

Related content

Uncertainty for North Sea energy island construction

Potential of wind assisted propulsion hindered by perception and funding challenges

Collaboration crucial to boost maritime green fuel production