Unlocking the promise of new nuclear

Leadership Insights Newsletter story

Nuclear power may be becoming technically viable for commercial shipping, but policy frameworks and perhaps even shipowning business models will also have to change.

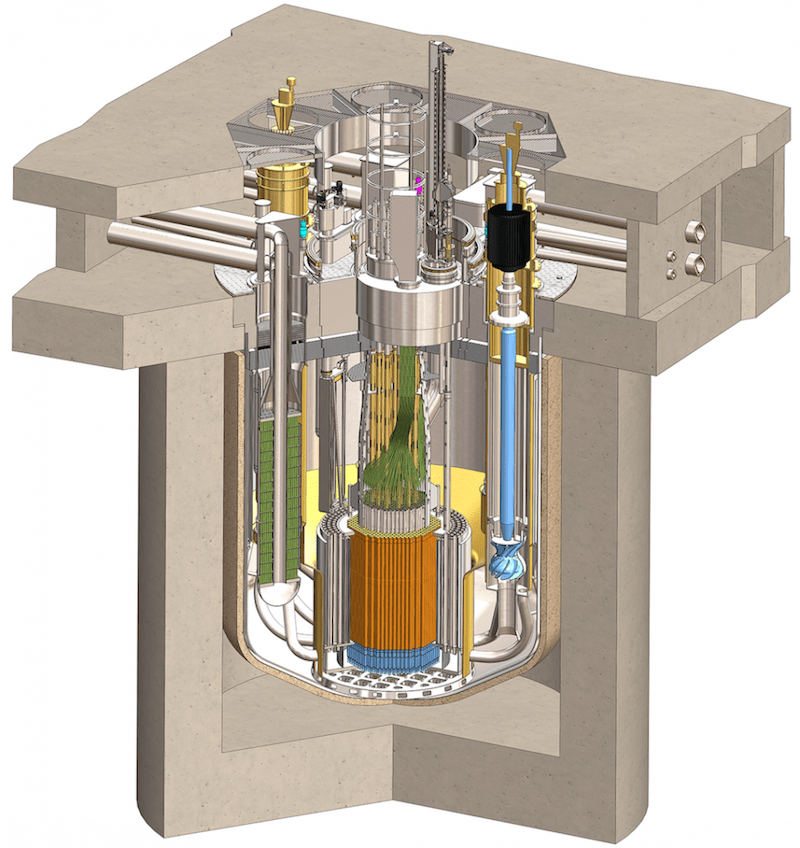

In early October, US energy provider Southern Company announced that it had started the first operational tests on a new nuclear power plant, TerraPower’s molten chloride fast reactor (MCFR). The tests, which are non-nuclear at this stage, mean observing operations as liquid salt is pumped around the plant as a coolant. With the subsequent addition of nuclear material, the chloride solution will become both fuel and coolant. The relatively low cost and ease of deploying such reactors, labelled ‘new nuclear’ in contrast to more expensive and unwieldy traditional reactors, could finally make nuclear power viable in commercial shipping.

The case for nuclear power in shipping is clear: nuclear reactors generate truly near-zero carbon energy. They need refuelling rarely, with molten salt reactors such as TerraPower’s needing nuclear material to be reprocessed every four to seven years, according to the World Nuclear Association. Those benefits translate to shipping as instant emissions compliance and bunkering intervals measured in years rather than weeks.

Core Power, which participated in the Southern Company test and has already designed a marinized, modular molten salt reactor is trying to bring those benefits to commercial maritime. According to its chairman and CEO Mikael Boe, shipowners are catching on fast to the potential. He identifies companies responsible for around 4,000 vessels as having already invested in researching and developing nuclear solutions. That interest tallies to the roughly 10% of respondents to the latest ICS Maritime Barometer Report that anticipated nuclear propulsion in commercial use within the coming decade.

“New nuclear is the only true zero emission energy for the lifetime of ships,” he tells ICS Leadership Insights. “Every capesize bulk powered by new nuclear will prevent 1.5 million tonnes of carbon dioxide from being emitted in dry cargo transportation. If you multiply that up the fleet, the impact is substantial.”

Those figures correlate with a 2010 academic paper identifying fuel-related carbon dioxide emissions from larger panamax bulkers at just over 1.5 million tonnes. On a lifecycle basis, though, nuclear propulsion does not totally eliminate greenhouse gas emissions, with the Intergovernmental Panel on Climate Change placing nuclear on a par with electricity generated from offshore wind, at 12gCO2e/kWh.

If the upsides of nuclear power are clear, so too are the challenges. They include concerns about safe operations, environmental unknowns around disposal of radioactive materials and lack of public policy frameworks – due in large part to public perception of nuclear risk.

Companies promoting the technology are tackling those historic safety concerns. Core Power’s reactor is designed to operate in a mobile environment, including ‘passive safety’ features that allow the reactor to be shutdown even in the event of a failure in auxiliary power. There are signs of a shift in public policy too, with Sweden and the UK among the countries bringing the International Maritime Organization’s (IMO) non-mandatory Nuclear Code into national legislation.

Insurance is another important consideration. According to Neil Roberts, head of marine and aviation at the Lloyd’s Market Association, nuclear commercial vessels are insurable in principle, although no such projects exist at the moment. He says that fresh ‘risk-by-risk’ assessment will be needed in each case and, perhaps more impactful for potential pilot projects, “not all [insurance] carriers will have the appetite to begin with”.

But the implications of commercial nuclear power go far wider than tweaking legal and policy frameworks. According to class society DNV in its latest Maritime Forecast, the underlying business model of ship powering may need to change. When aiming to compare annual cost and net present value for nuclear commercial propulsion, the company had to assume that shipowners would lease the reactor and associated systems and services. “This is because CAPEX for nuclear propulsion is uncertain but thought likely to be up to twice the cost of the ship itself,” the report noted.

That shift from built-in to leased power alone would be a radical change in shipping. But according to Christopher Wiernicki, CEO and chairman of class society ABS, even if shipping does not immediately move towards nuclear as a direct power source, there is still good reason to prepare for a new nuclear age. Arguably of greater importance is the role that new, affordable nuclear solutions can play in generating clean fuels that can be used in more conventional ship designs.

“We see nuclear energy as an enabler for producing clean energy and clean fuels and as a power source for ship propulsion,” he says. “Modern nuclear and renewable-based energy systems extend our line of sight of solutions to achieve net zero by 2050.”