Ammonia: The chemical chameleon underpinning green ambitions

Leadership Insights newsletter story

Can renewable ammonia production be scaled up in time to meet anticipated demand from an increasing number of users, including shipping?

It already keeps buildings cool, purifies water, bolsters agricultural yields and is one of seven base ingredients from which all chemical products are made, from plastics to textiles to medicines. Soon, as an efficient hydrogen carrier, it will also power industrial sectors that cannot be directly electrified, including shipping. But as demand grows for the Swiss army knife of industrial chemicals, how will producers of renewable ammonia keep pace? And how will shipowners claim their share amid so many competitors?

Production of renewable ammonia – either green ammonia produced from renewable hydrogen or blue ammonia where carbon emissions during production are captured – is in its infancy. According to a report from the International Renewable Energy Association[g1] (IRENA), less than 20,000 tonnes of renewable ammonia was produced in 2021, while production would need to reach 566 million tonnes by 2050 to fulfil Paris Agreement climate ambitions.

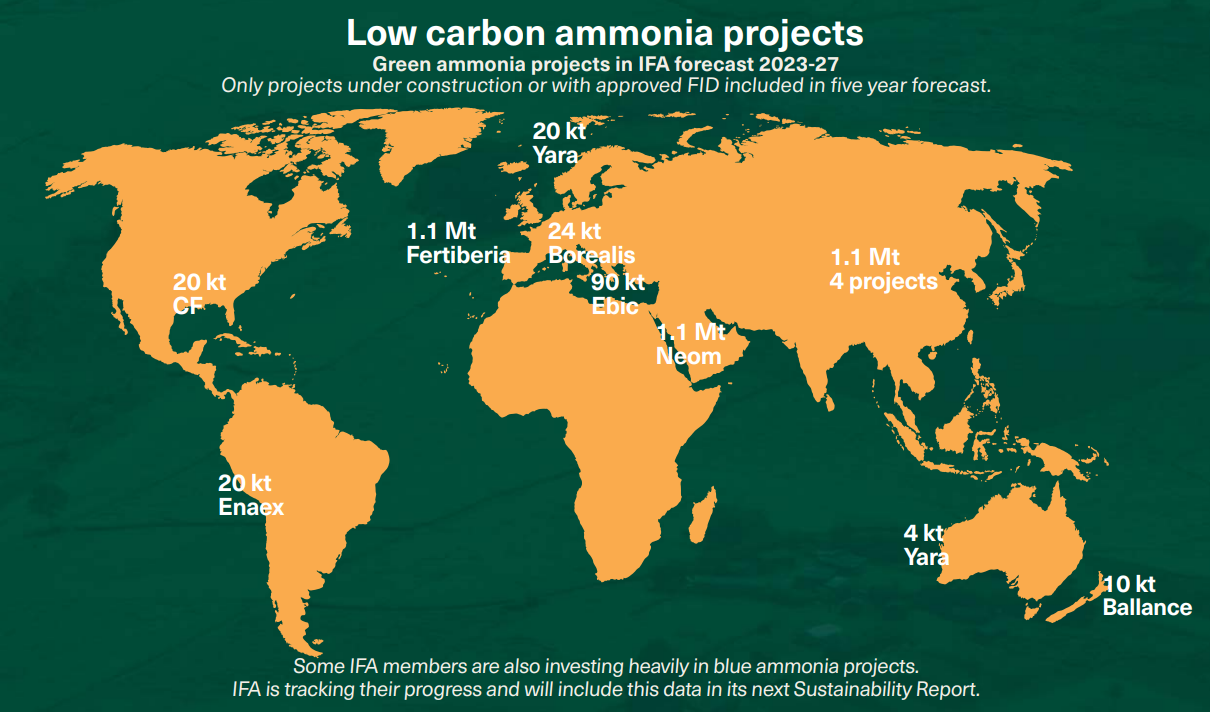

Around 70% of fossil ammonia – or 127 million tonnes – is currently used to produce nitrogen fertiliser, making agriculture a key driver in demand for a renewable alternative. International Fertilizer Association (IFA) market intelligence director Laura Cross tells ICS Leadership Insights that fertiliser producers around the world are in the process of making large-scale investments to decarbonise the supply chain through green or blue ammonia.

Those projects are included in 50 green ammonia facilities IFA has identified as currently under development, with 3.5 million tonnes of green ammonia capacity expected to start up in the next five years. Including projects to start production after 2027, there is a total of almost 85 million tonnes of green ammonia capacity currently under development. That covers under half of the demand from agriculture by 2030, according to IRENA’s projections. The game changer though is ammonia’s use as a hydrogen carrier and fuel. By 2050, IRENA predicts that more than half of demand will come from power uses.

Demand signals

“Ammonia is set to become a mainstream sustainable marine fuel and energy carrier by mid-century,” says Dominik Schneiter, CEO of Swiss marine engine designer WinGD. The company has already announced two orders for ammonia-fuelled engines. Both are from ship operators controlled by the Saverys family; eight bulk carriers to be built for Bocimar and two mid-sized ammonia carriers for Exmar LPG.

The gas carrier orders highlight an early driver in the uptake of ammonia as a marine fuel. A report from the University of Manchester’s Tyndall Centre[g2] , commissioned by ICS, suggested that 20 large ammonia carriers a year need to be built a year between now and 2030 to meet transport requirements, adding to the existing fleet of less than 450. With ammonia engine technology emerging, many of those could be early adopters of ammonia fuel, just as LNG, LPG and methanol carriers now use their cargoes as fuel.

With scale up plans to 2030 representing just over an eighth of anticipated 2050 needs, competition may be fierce for the fuel. According to Laura Cross from IFA, a pragmatic, collaborative approach to renewable ammonia supply will be essential to ensure all industries get the ammonia they need.

She says: “The fertiliser industry holds a huge amount of knowledge about the practicalities of producing, trading and storing ammonia, and has shown its eagerness to collaborate with the shipping sector. We see these two markets playing out in parallel rather than one leading the way over another.”

If availability can be scaled up, the demands of both industries – and more – should be fulfilled. Cooperation in securing production capacity investments is one way to make sure that happens and avoid a costly bidding war for a scarce resource.

Related content

A Zero Emission Blueprint for Shipping

Alternative fuels revolution an opportunity to boost trade resilience

Collective voice needed to deliver effective AI standards